On 17 October 2018 a panel session on Integrated reporting: Understanding the different methodologies was held in Auckland as part of the CPA Congress 2018. The session was chaired by Mark Hucklesby (National Technical Director, Audit at Grant Thornton) and the other panellists were Mark Yeoman (COO and CFO of the Warehouse Group Limited), Kate Alexander (Board Director of Ravensdown Ltd) and Wendy McGuinness (Founder and CEO of the McGuinness Institute). Mark provided an overview of integrated reporting and raised the question of why New Zealand is lagging behind international best practice in this area. Mark Yeoman shared his insights as a preparer of integrated reports and Kate shared her thoughts from a director perspective.

From right: Mark Hucklesby, Mark Yeoman, Kate Alexander and Wendy McGuinness at the Integrated Reporting panel discussion

Wendy shared five observations of factors that are likely to drive the move to integrated reporting:

- The IASB is showing no sign of producing non-financial standards any time in the future. Further, financial standards are increasingly including non-financial information, restricting the usefulness and accuracy of the term ‘financial statements’.

- Many for-profit entities are increasingly operating with not-for profit purposes. This creates a standards gap that fails to recognise the grey area between for-profit and not-for-profit entities often inhabited by social enterprises and similar entities.

- The gap between tangible assets (as presented in the financial statements) and intangible assets (as indicated by the figure for market capitalisation less tangible assets) is growing. Between 1975 and 2015, the percentage of market value accounted for by intangible assets in the US S&P 500 increased from 17% to 84%. In New Zealand the equivalent percentage for the NZX in 2017 was 60%. This suggests that reputation is an increasingly important component of an organisation’s intangible value as indicated on the stock exchange. It also highlights a gap between value as reported in financial statements and value as it operates in practice.

- Wellbeing (and different types of capital) are becoming increasingly important. This is evidenced by the six capitals in the IIRC framework and the four capitals in Treasury’s Living Standards Framework. The move towards wellbeing reporting is likely to be led by New Zealand’s 2019 Wellbeing Budget.

- Climate change reporting urgently needs to be improved. Climate change risk is not currently well reported by individual organisations, which is leading to the nationalisation of climate change risk (in much the same way that social welfare is nationalised). This means the government must find ways to strengthen information infrastructure to keep New Zealanders informed. This will then enable us to more evenly distribute climate change risks and opportunities and make them more manageable. The Institute is proposing that a Statement of Climate Change Information be included in regulatory filings, requiring it to be prepared by any organisation that is also required to file financial statements. To find out more about this proposal, see Think Piece 30 – Package of Climate Change Reporting Recommendations.

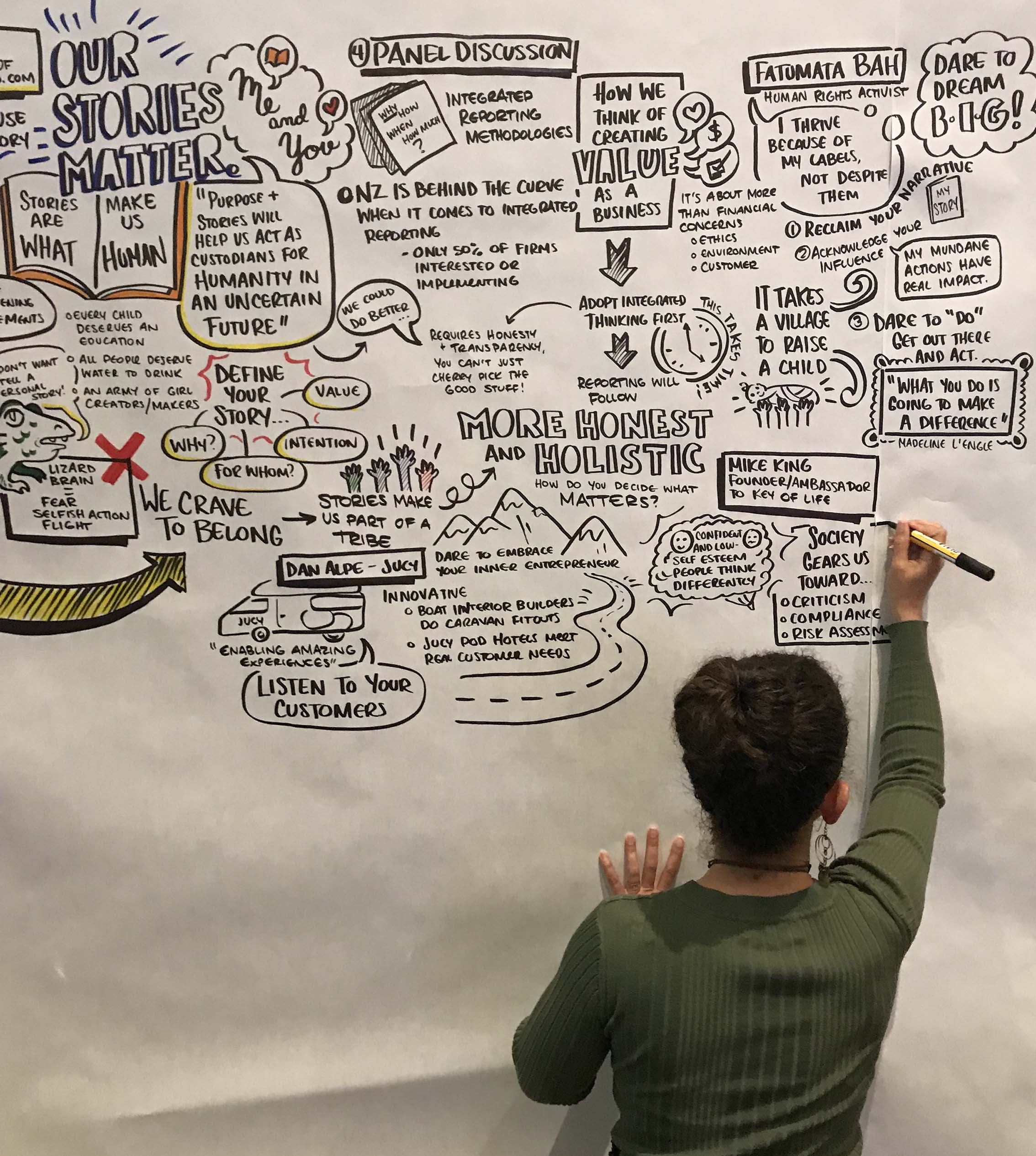

Visual notes from the Integrated Reporting panel discussion